Company

Affirm is fintech company in the BNPL space with two sided marketplace: consumers and merchants.

Product

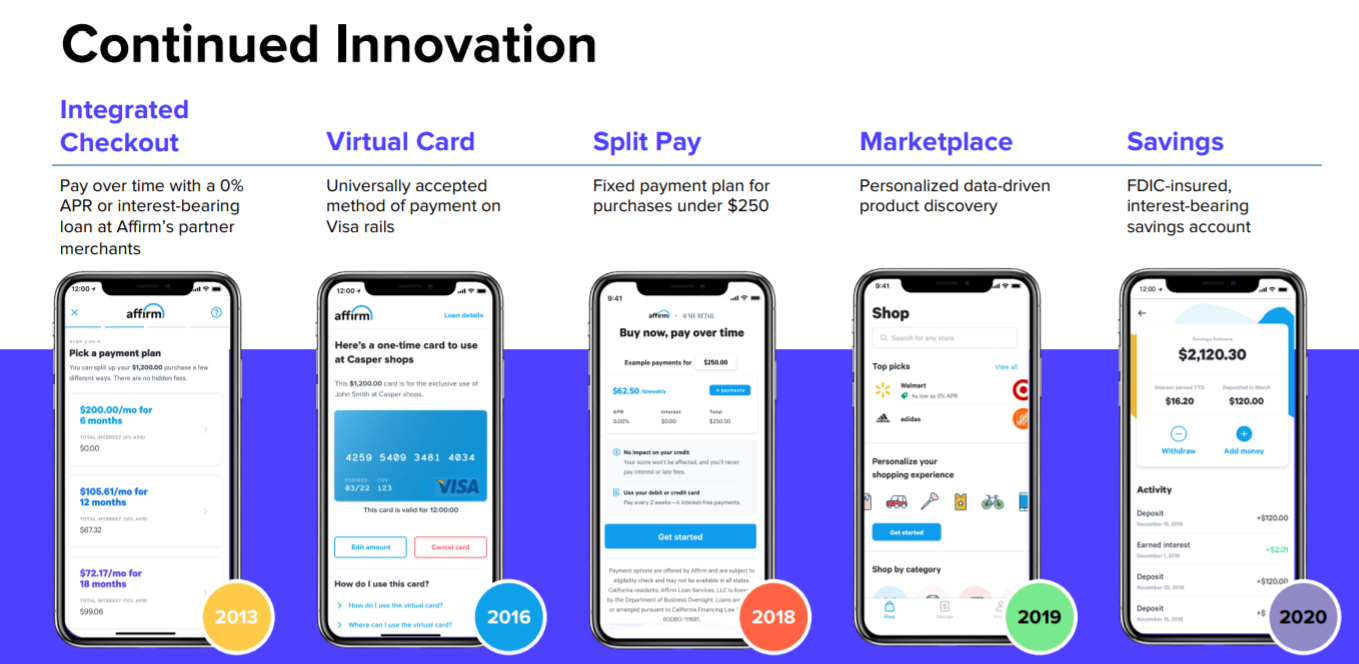

Consumer Platform

- Integrated Checkout

- Virtual Card

- Split Pay

- Marketplace

- Savings Account

Coming soon: Debit+

- Debit card where any payments can be made in Affirm payment plans

Merchant Platform

- Ads/Promos

- Checkout/POS Network

Business Model

Affirm originates loans through banking partner, and the bank partner funds the loan of its own funds and may sell the loan back to affirm. Affirm has agreements with these partner where they are obliged to purchase all loans facilited through the platform. Bank partner also keeps interest in loans via loan performance fee.

Affirm BNPL for customer results in 85% higher order volumes and 20% increase in repeat purchases.

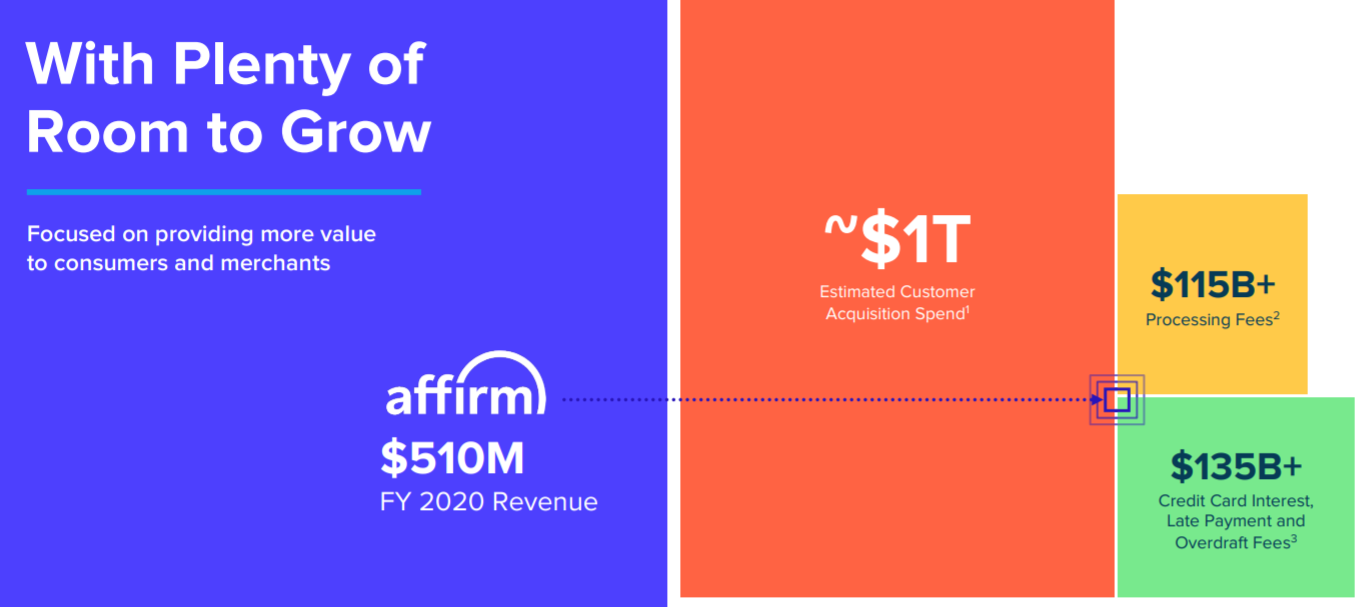

Merchant Fees

- Core 0% Long Term – 10%

- Core 0% Short Term – 5%

Merchant Network fees (44% of revenue)

- Affirm charges 2-4% for every sale through platform

- Merchants pay fee for payment process and so Affirm can take risk of payment default

- 380M (+48% YoY)

Virtual Card Network fees (6% of revenue)

- Affirm facilitates issuance of virtual cards directly to consumers through their app.

- When virtual cards are used, they earn a portion of interchange fee from transaction.

- 50M (+158% YoY)

Interest income (37% of revenue)

- 43% of loans are 0% APR

- average loan size is $750

- loans up to $17,500

- Peloton is still 9% of affirm GMV

- 222M (+75% YoY)

Gain (loss) on sales of loans (10% of revenue)

- Affirm sell loans to whole loan buyers and securitization investors through forward flow arranges and securitization transactions

- 89M (+128% YoY)

Servicing fees (3% of revenue)

- Affirm earns a servicing fee on loans they sell to funding sources

- Affirm does not sell servicing rights to control consumer experience end-to-end

- Partner with subservicers to manage customer care, priority collections and 3rd part collections

- 24M (+67% YoY)

Core Metrics

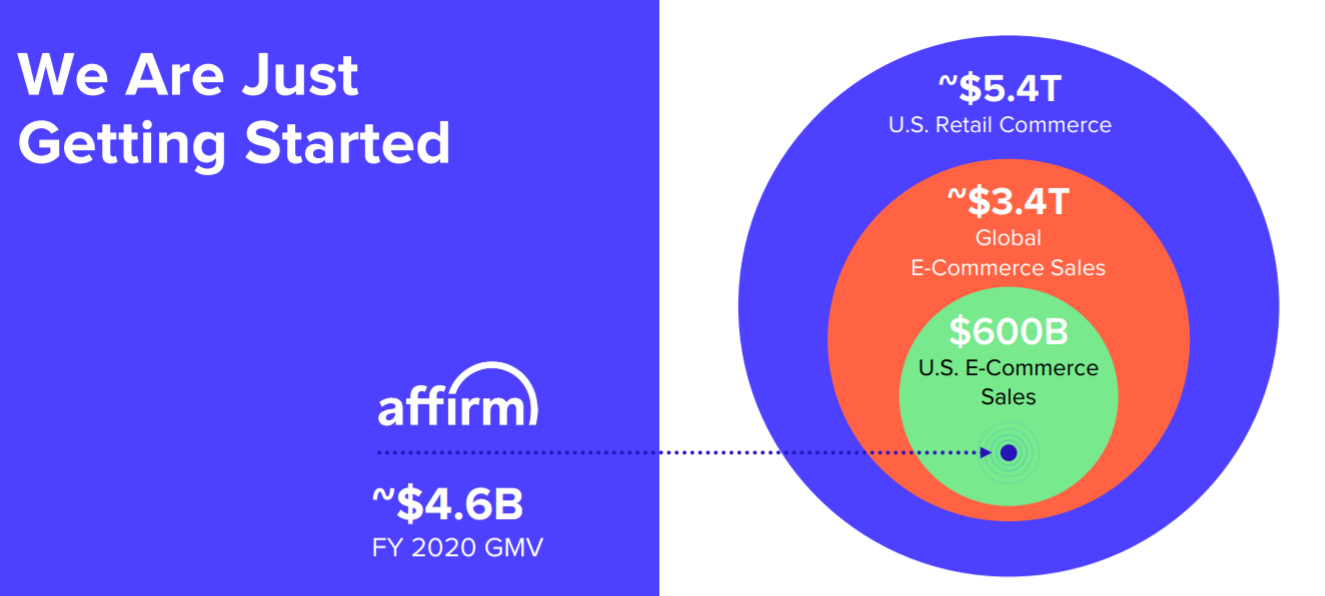

- GMV:

- Q421: $2.3B Q3 (+67% from 2020)

- F22: $13.13B-$13.38B (expected)

- Revenue (less transaction costs):

- Q1 2022: $269.4

- Q2 2022: $325

- F22: $1.25B

- Loss: 62M

- Active consumers: 7.1M

- Transactions per active customer: 2.3

- Active merchants: 250k

Competitive Moat

Brand

Affirm has built up customer trust in it’s brand for unsecured cash loans. Even when payments are late, Affirm will not charge fees or spam customers with collection calls. I believe their goal to really make customers comfortable with these loans will result in long term customers that enjoy the experience of BNPL.

- NPS Score: 78 (apple is 89, tesla is 97)

Fraud Models

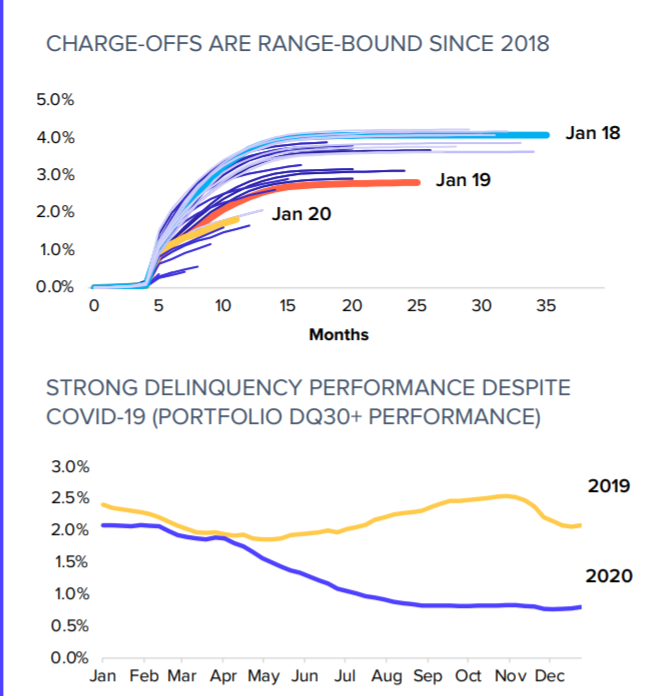

Affirm claims to beat current credit scores using their proprietary models. (need to look into their loss ratios)

- 1B+ unique datapoints

- 40-80 specific inputs for fraud

- 200+ consumer data points for risk management

- 7M+ loans

Partnerships

Amazon

- Exclusive partnership with Amazon (until 2023)

- Amazon currently has flexible payment plans but poor user experience

- Currently in testing phase with select customers

- Purhcases of $50 or more

Shopify

- Affirm has exclusive partnership with Shopify to make ShopPay installments

- In June 2021, Affirm launched ShopPay to all merchants (purchases > $50)

Walmart

- Parternship with Walmart for BNPL (Exclusive?)

- Purchases from $144 – $2000

- Instore Integration

- Signup on https://www.affirm.com/shop/walmart

- Scan barcode at checkout to get credit

- Pay through Affirm app

- Ecommerce Integration

- Pay via walmart.com

- 10-30% APR

Target

- (Exclusive?)

- Ecommerce integration via target.com

- 10-30% APR

Apple Canada

- 0% APR

- via Paybright (affirm acquisition)

- Apple US financed via Apple Card (Goldman Sachs)

Competitors

Klarna

- European company headquarters in Stockholm

- Valued at $46B

- Retailers

- Etsy

- Macys

Afterpay (acq by Square)

- 37B AUD company

- Retailers

- Allbirds

- Petsmart

Paypal Credit

- Paypal credit is a BNPL service offered by Paypal

- Many online customers already have PayPal, so there they have advantage in vertical integration

- However, Paypal has low NPS and trust with customers

- Retailers

- Ebay

Visa

- Visa is part of the legacy ecommerce network that Affirm is trying to disrupt

- Instore credit cards for financing

Market

Analysis

I have personally used Affirm multiple times for big and small purchases (mattress, pillow, coffee, watch) and I have been delighted with the easy experience and 0% APR. Compared to legacy business for loans (in store credit card, credit cards), Affirm offers a much better experience and trust model for the customer. Affirm will change the way people purchase items and think about financing.

In China, microloans are very common with many tech companies and startups offering ways to pay over time and with many unbanked customers. Currently, in the US, consumers are just beginning to get used to microlending and as people get comfortable breaking up payments for smaller things the market will be huge. If you thought Americans had huge appetite for debt, we’ve only getting started.

I believe Affirm has MANY headwinds that will help them grow very fast. They have a proven track record of strong growth and ability to scale. With two major ecommerce behemoths as partners, Affirm still has a massive amount of grow.

There could also be many factors that could limit Affirm’s growth. Affirm has many competitors trying to get into the space that could undercut Affirm to merchants (by charging higher customer fees). There is also a lot of regulatory risk as we’ve seen with microlending in China. Affirm will also be quite dependent on it’s partners to be drivers of revenue.

At time of writing (9/19/2021), Affirm has a revenue multiple of 80x which is quite high even for a tech stock. At it’s current trajectory, I believe in 4 years (2025), Affirm has the potential to hit 100B in GMV and bring in $4-5B in revenue (less transaction costs) as a $100B company (3-4x upside).

Links

https://investors.affirm.com/static-files/18f24d87-9ccd-4e3d-9253-dff937441677

https://investors.affirm.com/