Company

Latch is enterprise SaaS company for property management

Products

Residential Smart Access

- Core hardware smart lock for physical entry access

- Allow residents to unlock with mobile app, code, keycard or smart watch

- Enterprise SaaS platform to allow building managers to reduce opex

- Key management

- Maintenance access

- Smart home monitoring

- Prospect showings

Add-ons

- Smart-home sensor

- Building wide wifi

- Guest and delivery management

- Intercom

- Rental Insurance

New Product: Commercial Office

- LatchOS for commercial office buildings

- Launched in Empire State Building, Brookfield Place

- Latch Visitor Express

- Guest management via Latch

- Future:

- Garage

- Elevators

Business Model

- Latch is an Enterprise SaaS platform that helps property managements lower opex and provide additional residential services

- Reduce expenses $100-300 per apt per year

- Can increase revenue $200-500 per apt per year (customers willing to pay more)

- $7-12/month per unit

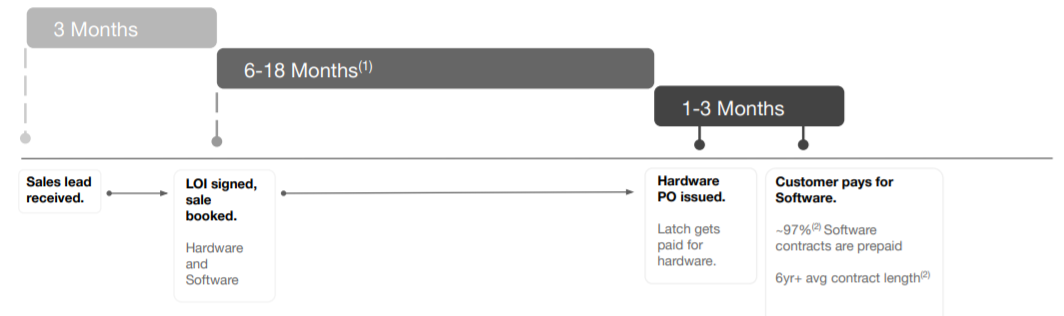

- Average initial delivery timeline: 6-18 months

- Retrofit deals are shorter (50% retrofit)

- New construction deals are longer end

- High upselling potential: 154% net dollor retention

- 90% attach rate of 2 or more LatchOS modules

- Unit Economics

- Avg 6+ year deals

- 97% of customers prepay

- 0% customer churn

- 6.8x LTV/CaC, 4.0x LTV/CaC (with hardware loss)

- TAM

- 47M apartments in US

- 32M multifamily apartment units

- 93M apartments in Europe

- 47M apartments in US

- No direct competitors

Core Metrics

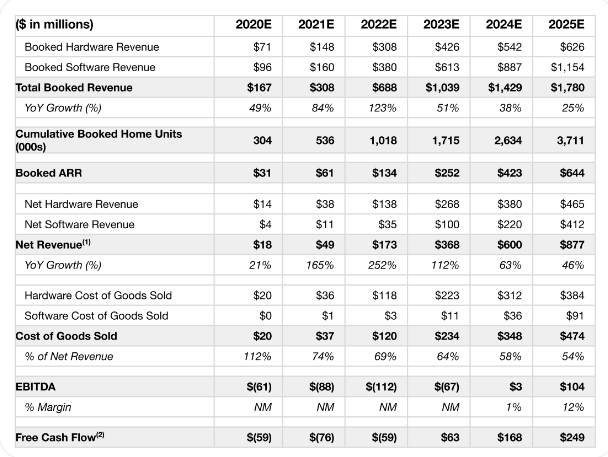

- Total booking (Q3): 95M (+102% YoY)

- Full year (F21): 325-340M (+97% YoY)

- Total Booked ARR: 50M (+122% YoY)

- Booking represent signed customer LOIs to purchase hardware and software with target delivery date no later than 24 months following signature

- Sum of total hardware and software revenue commitment over life of software agreement

- Total booked units: 451k (+108% YoY)

- Revenue: 9M (+227% YoY)

Spac Projection

(Honestly, their finance guy must have huge balls to project $1.7B of booked revenue in 2025 while they only pulled $9M in revenue when he drafted this)

Partnerships

- AvalonBay

Analysis

Latch has a grand mission to become the one platform for buildings. The ability for residents, visitors, guests and management to seamlessly interact with buildings via LatchOS will transform the way we live and work.

From a SaaS point of view, Latch looks very attractive. By having hardware in every door, this ensure that there is a high cost of switching between vendors. Charging by apartment per month is also very compelling as this provides very reliable recurring revenue. Latch also has high upsell abilities and cross-selling into other buildings from the same customer.

There are many smart locks on the market but they do not provide the wholistic management that Latch does. Latch has no direct competitors meaning they have lots of room to gain a headstart on vendor lockins before new companies move in to the space.

Latch is different from normal SaaS as their sales cycles are much longer and rely on reporting “Booked Revenue” for guidance. At first glance, Latch has a 100x multiple on revenue which is quite expensive. But looking closer at their growth numbers and projections, this valuation may be quite small. If we believe Latch’s growth projections and no viable competition, we can see Latch dominate the space and easily become a 20B company (10x upside) in 4-5 years.

References

https://www.dropbox.com/s/ngoz7eaa1uehn43/Latch%20Investor%20Presentation.pdf?dl=0