Security cloud company that leverages network effects of crowdsourced data

Product

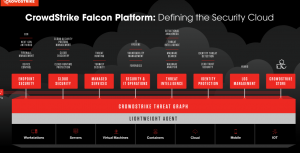

- CrowdStrike Falcon Platform (19 modules)

- Falcon Prevent: Antivirus

- Falcon X: Threat intelligence

- Falcon Device Control: USB device control

- Falcon Firewall Management: Host Firewall Control

- Falcon Insight: Endpoint detection and response

- Falcon Overwatch: Threat hunting

- Falcon Discover: IT hygiene

- Crowdstrike Services:

- Incident Response and Proactive services

Crowdstrike Falcon Platform:

- Cloud agnostic: AWS, Azure, GCP

- Kernel level security agent

- Proprietary distributed threat graph:

- 5+ Trillion events/week

Business Model

- Sell subscriptions to Falcon platform and cloud modules that leverages channel partners

- Also generate revenue from response and proactive professional services

- Low friction land-and-expand sales strategy

- 1-3 year contracts

- Revenue:

- Subscription revenue (94%):

- Endpoints per customer and number of cloud modules

- Professional services revenue:

- Incident and proactive services

- Forensic and malware analysis

- Attribution analysis

- Subscription revenue (94%):

- Cost of Revenue:

- Subscription cost: hosting Falcon platform in data centers, costs with operations and support personnel

- Professional services: employee-related costs

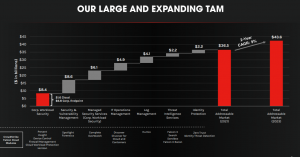

- Cloud security spend (~1% of IT spend):

- 2020: $1.2B

- 2023: $2B est

- Revenue: $1.4B

- Geography

- 72% US

- 28% Other

- Geography

Core Metrics

- Revenue: $1.4B (+70% YoY)

- Revenue Q2 2021: $337M

- Subscription: $315M

- Prof services: $21M

- Cost of revenue: $90M

- Gross Profit: $247M

- Gross margin: 73%

- Revenue Q2 2021: $337M

- 94% Subscription revenue

- Customers: 13080 (+81% YoY)

- 234 of F500

- 66% customers with 4+ modules (57% last year)

- NDR: 125%

- Gross margin: 76%

Competitors

- Symantec: acq by Broadcom

- CarbonBlack: part of vmware suite

- SentinelOne: not as mature product

- Performed better in MITRE test: https://attackevals.mitre-engenuity.org/enterprise/participants/crowdstrike/?adversary=carbanak_fin7

- McAfee

- Cylance

Competitive Moat

- Crowdstrike is the Gardner magic quadrant leader for cybersecurity

- Lightweight robust agent:

- Well optimized user agent with more functionality compared to other security agents

- Agile deployment (quick frictionless update w/o reboot)

- Supported on all OS

- Detection

- Doesn’t require signature for every single threat

- Data and AI

- 5+ trillion datapoints for Crowdstrike to learn from

- High precision models to detect threats

- Threat intelligence

- Actor attribution, sandbox analysis and malware search

Analysis

Cybersecurity is a quickly growing market as IT spending increases and security breaches become more frequent and prolific. I believe Crowdstrike’s sole focus on creating a cloud native cybersecurity platform puts their product at the front of the line and IT departments for enterprise customer will only want the best cybersecurity platform to protect their systems and data.

As new attack vectors grow and expand, I believe Crowdstrike can develop and scale new products to upsell to address the never ending arms race in cybsersecurity.

Their ability to maintain growth 84% YoY at >$1B has been incredible and top in class for SaaS. Their current valuation at 60B (42x rev) is pricey but well justified. If they are able to maintain their dominant market position and high growth, we could see Crowdstrike hit $7B in revenue in 3 years at a $200-300B valuation (3-4x upside)