Company

Sofi is a fintech company with the mission of being the financial platform for consumers

Products

Lending

- Student Loan Refinancing (505k)

- Personal loans (628k)

- Home loans (30k)

- In school loans

Galileo (Technology Platform)

- Galileo

- API for virtual credit cards

Financial Services

- SoFI invest (866k users)

- brokerage, crypto

- SoFi Money (989k users)

- cash management account

- SoFI Credit Card (102k users)

- Relay (800k users)

- Tracks your money, budget tool

- Lantern (?)

- redirect you to another lender

- Protect

- Insurance

- At Work

- ECM

Corporate

Business Model

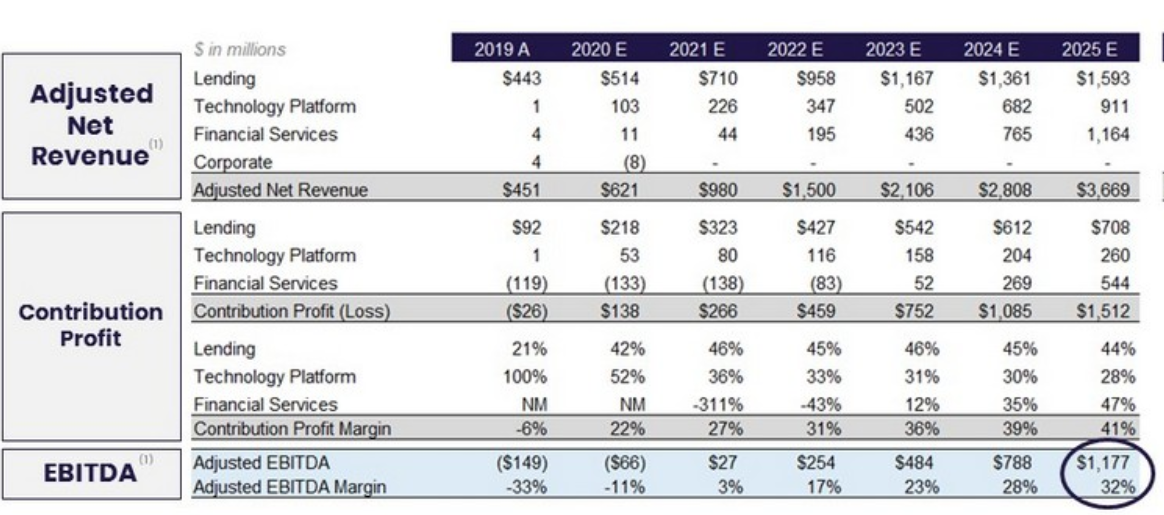

- Lending (72%)

- 10B origination (+4% YoY)

- 710M revenue

- 365M net revenue

- 981k loans (+14% YoY)

- Technology Platform [Galileo] (23%)

- 226M revenue

- 70M net profit

- 79M accounts (+119% YoY)

- Financial Services (<5%)

- 44M revenue

- -133M net loss

- 2.6M products (+243% YoY)

- Crossbuying – 24% of product sales come from cross buy at low acq cost

Core Metrics

- F21 Expected Revenue: 852M (+37% YoY)

- Lending 677M (+26% YoY)

- Galileo: 166M (+72% YoY)

- Financial Services: 30M (+172% YoY)

- Corporate: -23M

- 2.5M unique members (+113% YoY)

- 3.7M products (+123% YoY)

- 79M Galileo accounts (+119%)

- Lending: 10B origination (+4% YoY)

Analysis

Personally I believe the digital banking services offered by existing incumbent banks already offer great services. Lending is Sofi’s main product but I believe lending is already a highly commoditized product with many players offering competitive rates.

Sofi revenue is heavily weighted on lending right now but their lending growth seems to be slowing down. Sofi is banking that their other financial services are able to grow to keep up their financials. They have been able to cross-sell their newer financial products quite quickly to their existing customer base but I find it difficult to believe that they will be able to scale and grow these businesses at a significant enough scale to make a good profit.

Let’s do some back of the napkin math. Robinhood makes $112 per user per year, banks make $180 per credit card per user and $400 per checking account. Assuming $700 per user and Sofi is able to cross sell 1M users in 2-3years, that would be an extra $700M in revenue. Sofi would also need to ramp up their costs to able to build out the financial infrastructure to service all their customers with the services they need and in compliance with all the state and federal regulations.

At current valuation of 14x revenue multiple and 37% YoY growth, Sofi is relatively cheap. But if you dig into their growth numbers, it doesn’t look promising as their main money maker lending is stalling (26% YoY) and they are banking on their financial services. If you believe Sofi can follow through with their ambitious plans of transitioning to a financial services platform, Sofi might be a great steal right now.