Company

Hims is telehealth company with direct to consumer prescriptions

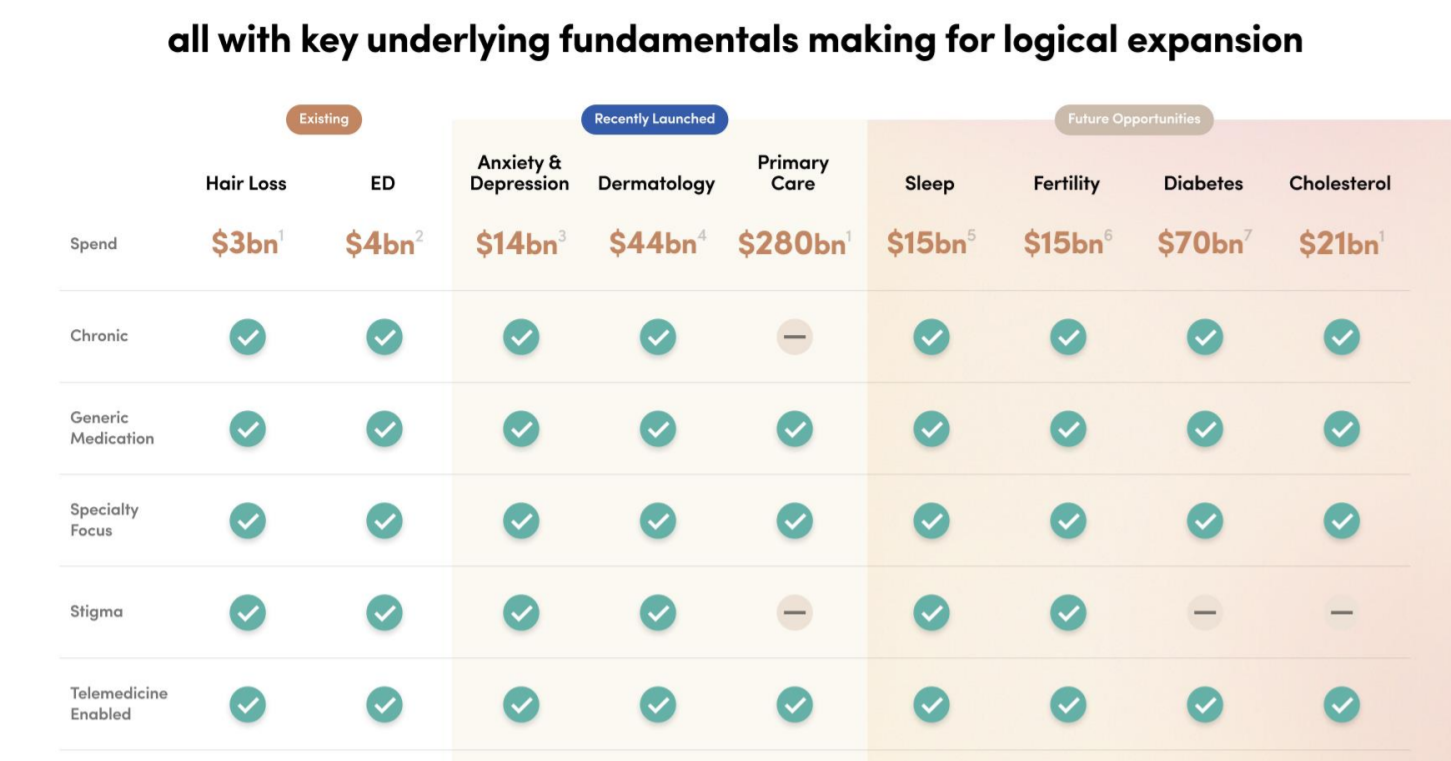

Products

Hims offers direct to consumer prescription products.

Main Product Lines (% from Q2 2020)

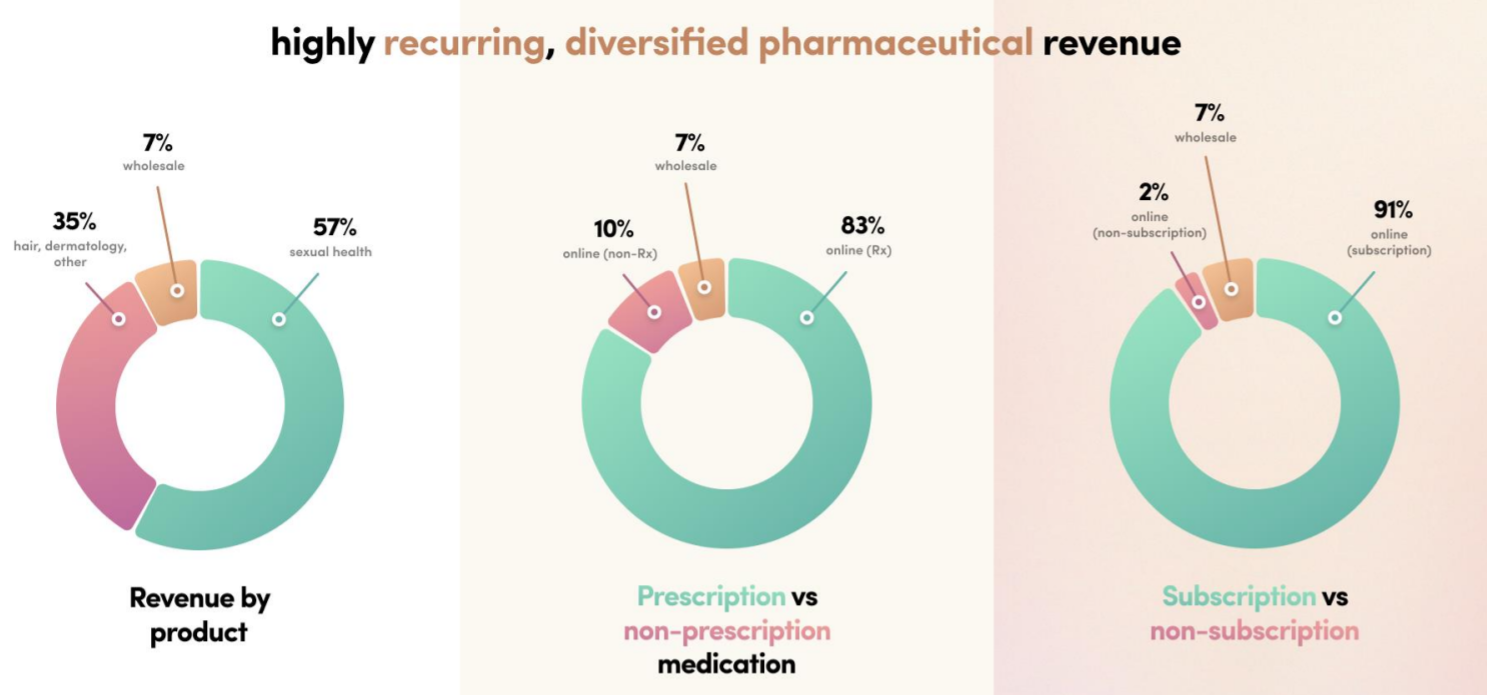

- Sexual Health (57%)

- ED, PMJ, STD

- Hair, derm, other (35%)

- Hair: Prescription minoxidil and finasteride

- Derm: Prescription retinol

- Wholesale (7%)

- non prescription

- Mental Health( ?)

- Anxiety & depression

- Online therapy

- Women’s Health (?)

- Prescription birth control

- Primary care

- $39/visit

I was not able to find a recent breakdown of Hims product lines and I would be interested to see how their other segments are performing. In a recent Q3 earnings call, the CEO says that the mental health segment has doubled.

Currently, Hims does not take health insurance.

Business Model

- Hims offers tele consults for prescription drugs and sends them directly to customers

- 50% of order volume fulfilled from Ohio center (rest is fullfilled by 3rd party)

- 332 Licensed providers for consults

- They have nurse practitioners capable of prescribing some of their products

- 4.6MM telehealth consultations since launch

Core Metrics

- Revenue (Q3 21): 74M

- F22: $264M

- Online (Q3 21): 72M

- Wholesale (Q3 21): 2M

- Gross profit: 47M

- Gross margin: 78%

- Revenue (F21): 251M expected

- Net Orders (Q3 21): 968k (+37%)

- AOV (Q3 21): $74

- Subscriptions: 551k (+76%)

- 80% of customers are first time buyers

- 88% long term retention

- Marketing Spend = 67%

- Selling, G&A = 55%

- Operating loss = -23%

Partnerships

Celebrity Brand Ambassadors

- Miley Cyrus (46.3M Twitter followers)

- Jennifer Lopez (45M Twitter followers)

- Rob Gronkowski (3.1M Twitter followers)

Analysis

Hims has a very compelling business model and vision. I believe in their mission to become a complete healthcare platform and change how people approach healthcare.

Hims has been a very fast growing DTC startup growing from $0->$100M in revenue in 2 years. They have scaled efficiently and continue to grow into new segments.

I think if Hims is able to accept insurance, they can break out in the primary care market. $39 out of pocket for a consult seems prohibitively high.

I believe Hims is quite undervalued with its high growth (+80% YoY), high subscription revenue (91% online subscription) and high gross margins (78%). While it currently trades at 8.5x revenue multiples, Hims has a lot of upside when investors finally wake up. If Hims is able to maintain its margins, growth rate and vertical expansions, we could see Hims become a 20B (10x upside) healthcare disruptor in 3 years.